Table of Contents

- BA Stock Is on Its Way Back to 0 This Year | InvestorPlace

- BA Stock Price and Chart — NYSE:BA — TradingView — India

- Boeing Stock (BA) Plunges After Earnings – Trade Alert – Jul 25 2018 ...

- The Reaction to Earnings Matters More for BA Stock Than the Results ...

- BA Stock Price - Boeing Co Stock Candlestick Chart - StockScan

- BA Stock: Boeing Stock Hits Record Overbought Level | InvestorPlace

- Can The Boeing Company (BA) Stock Fly Any Higher? - Insider Monkey

- BA Stock Price and Chart — TradingView

- Ba Stock 2025 - Lorna Rebecca

- BA Stock Price and Chart — TradingView

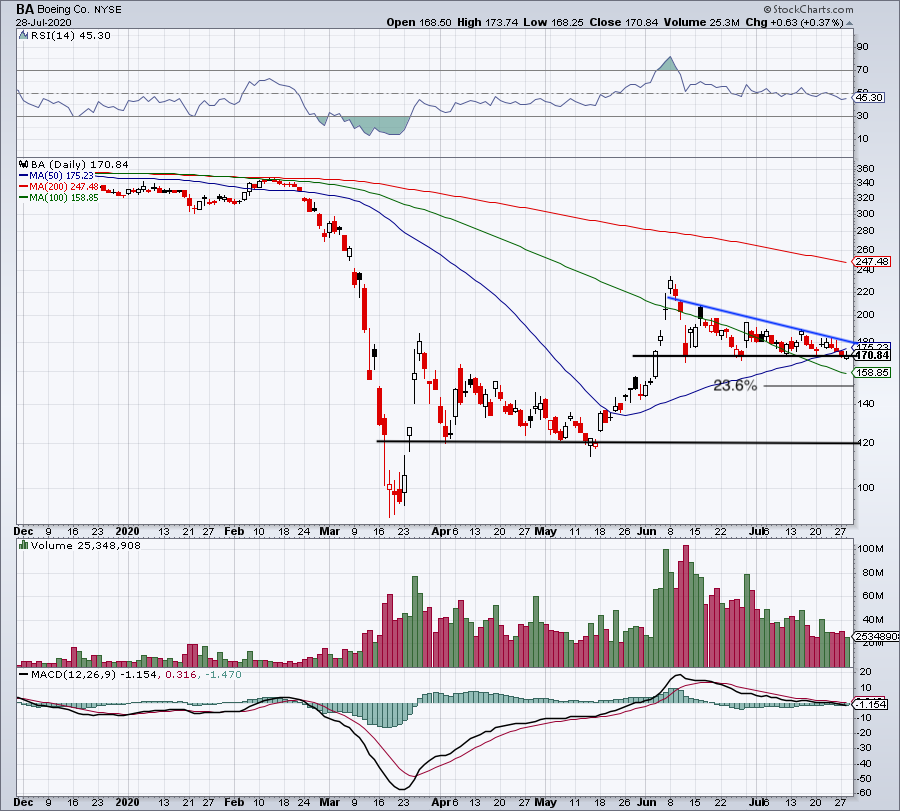

Current Stock Price and Performance

Financial Performance

Strengths and Weaknesses

Boeing has several strengths that position it for long-term success. These include: Strong brand recognition: Boeing is one of the most recognized and respected brands in the aviation industry. Diversified product portfolio: The company has a wide range of products, including commercial airplanes, defense, space, and security systems. Global presence: Boeing has a significant presence in over 150 countries, with a large and diverse customer base. However, Boeing also faces several weaknesses, including: Intense competition: The aviation industry is highly competitive, with companies like Airbus and Lockheed Martin competing for market share. Regulatory risks: Boeing is subject to strict regulations and safety standards, which can impact its ability to operate and deliver products. Supply chain disruptions: The company is reliant on a complex global supply chain, which can be vulnerable to disruptions and delays.

Future Prospects

Despite the challenges facing Boeing, the company has a strong foundation and a clear strategy for growth. Boeing is investing in new technologies, such as electric and autonomous systems, and is working to increase production rates and deliver aircraft to customers. The company is also focused on expanding its services business, which provides a steady stream of revenue and helps to reduce dependence on new aircraft sales. Additionally, Boeing is exploring new markets, such as space and defense, which offer significant growth opportunities. In conclusion, Boeing's stock price and performance have been impacted by the challenges facing the aviation industry. However, the company has a strong foundation and a clear strategy for growth, with a focus on new technologies, increased production rates, and expanded services. As the aviation industry continues to recover from the COVID-19 pandemic, Boeing is well-positioned to capitalize on new opportunities and drive long-term success.Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Investors should do their own research and consult with a financial advisor before making any investment decisions.