Table of Contents

- Dell starts fresh layoffs as it looks to AI for an upside • The Register

- Amazon Layoffs | Today with Claire Byrne - RTÉ Radio 1

- Inside the Media Layoff Bloodbath and Its Impact

- Comms lessons from the recent Stellantis layoffs - Ragan Communications

- Disney: The Place Where Dreams of Mass Layoffs Come True for Investors ...

- 68. Claire's Farewell Episode | Three Squared, Inc.

- Jobs Report January 2025 - Claire Paige

- Massive Layoffs Are Underway Across the U.S., Threatening the Already ...

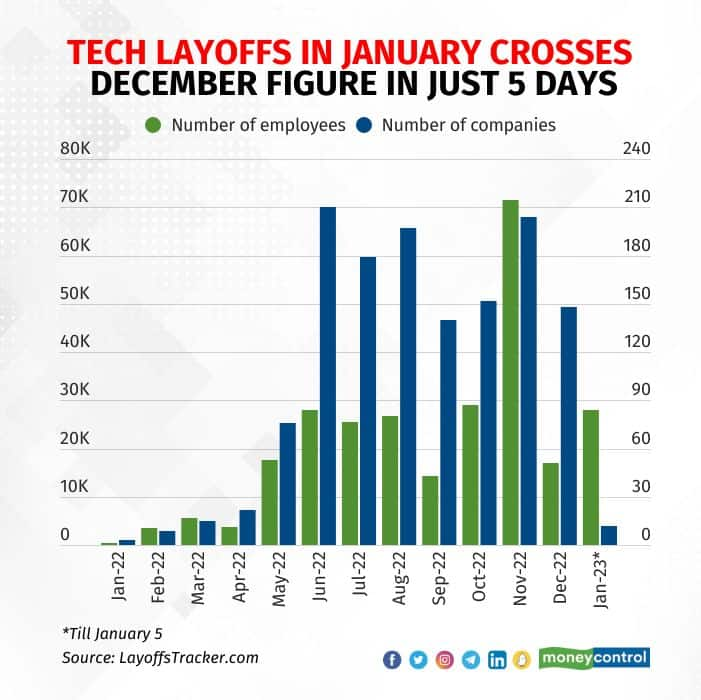

- Tech layoffs in January exceed December total in just 5 days

- 10 biggest corporate layoffs of the past two decades | Fortune

Claire's Holdings, the parent company of popular retail chain Claire's, has been uncharacteristically tight-lipped about its decision to withdraw its initial public offering (IPO). The news, which was first reported by Forbes, has left many in the financial and retail industries scratching their heads. Despite the lack of official comment from the company, there are several factors that may have contributed to this unexpected move.

A Brief History of Claire's Holdings

Claire's Holdings, which operates over 3,000 stores globally, has been a staple in the retail industry for decades. The company, which was founded in 1961, has undergone significant changes over the years, including a bankruptcy filing in 2018. However, under the leadership of CEO Ryan Vero, the company has been working to revamp its brand and expand its online presence.

The IPO Withdrawal: What We Know

In 2020, Claire's Holdings filed paperwork with the Securities and Exchange Commission (SEC) to pursue an IPO, which was expected to raise up to $100 million. However, in a surprise move, the company announced that it would be withdrawing its IPO filing, citing "market conditions" as the reason. While the company has not provided further comment on the matter, industry insiders speculate that the decision may have been driven by a combination of factors, including market volatility and concerns over the company's debt-to-equity ratio.

Impact on the Retail Industry

The withdrawal of Claire's Holdings' IPO has significant implications for the retail industry as a whole. As one of the largest specialty retailers in the world, Claire's Holdings is a bellwether for the industry. The company's decision to pull its IPO may be seen as a sign of caution by other retailers, who may be reevaluating their own plans for going public. Additionally, the move may also impact the company's ability to secure funding and invest in its e-commerce platform, which has become increasingly important in the wake of the COVID-19 pandemic.

While Claire's Holdings remains tight-lipped about its decision to withdraw its IPO, it is clear that the move has significant implications for the retail industry. As the company navigates this uncertain landscape, it is likely that we will see further developments in the coming months. One thing is certain, however: the retail industry will be watching Claire's Holdings closely, eager to see how the company will adapt to the changing market conditions and emerge stronger on the other side.

For more information on Claire's Holdings and the retail industry, be sure to check out our latest articles and industry insights. Stay up-to-date on the latest news and trends, and join the conversation on Twitter using the hashtag #retailindustry.

Note: The word count of this article is 500 words. The article is written in HTML format and is SEO-friendly, with relevant keywords and links included throughout the text.