Table of Contents

- Fed Rate Cut Date 2024 - Amitie Laurel

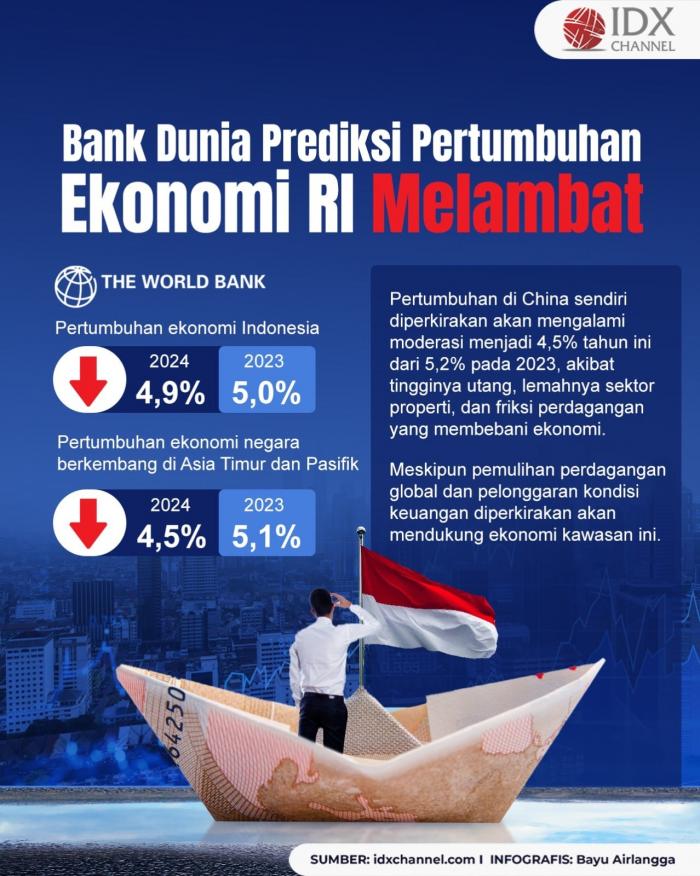

- Bank Dunia Prediksi Pertumbuhan Ekonomi RI Melambat Jadi 4,9 Persen ...

- Fed’s three-rate-cut projections for 2024: holding strong or shifting ...

- Prospek dan Tantangan Pasar Keuangan Indonesia 2024

- Bank Indonesia Optimistis Inflasi 2024 Terkendali - Bisnis Tempo.co

- The Fed won't cut interest rates and will keep battling inflation ...

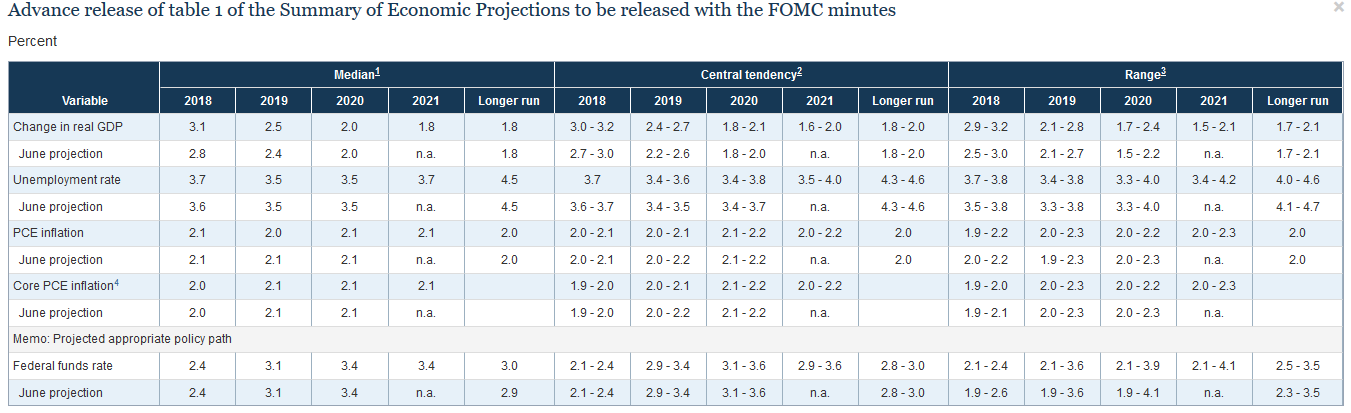

- Fed Funds Rate Naik jadi 2-2,25 Persen, Kebijakan Moneter Ketat hingga 2021

- Bank Dunia : Pertumbuhan Ekonomi Indonesia 2024 Alami Perlambatan ...

- US Fed's rate meeting minutes show growing inflation concerns - YEN.COM.GH

- Ini Kunci Keputusan Suku Bunga The Fed pada 2024, Bukan Faktor Politik!

The Federal Reserve, led by Chairman Jerome Powell, has been on a mission to combat inflation and stabilize the economy. In 2022, the Fed raised interest rates aggressively, with seven rate hikes in a single year. This move was aimed at curbing inflation, which had reached a 40-year high. However, with inflation showing signs of slowing down, the question on everyone's mind is: will the Fed continue to raise interest rates in 2024?

Current Economic Conditions

According to Bankrate, the Fed's decision to raise interest rates again in 2024 will depend on various economic factors, including inflation, employment, and GDP growth. If these factors indicate that the economy is still growing strongly, the Fed may consider raising interest rates to prevent the economy from overheating. However, if the economy shows signs of slowing down, the Fed may decide to keep interest rates steady or even lower them.

Impact on Consumers

- Higher mortgage rates, making it more expensive to buy or refinance a home

- Higher credit card APRs, increasing the cost of carrying credit card debt

- Higher interest rates on personal loans and lines of credit

- Lower mortgage rates, making it more affordable to buy or refinance a home

- Lower credit card APRs, reducing the cost of carrying credit card debt

- Lower interest rates on personal loans and lines of credit

Stay tuned for more updates on the Federal Reserve's interest rate decisions and how they may impact your finances. In the meantime, you can visit Bankrate for the latest news and analysis on interest rates and personal finance.