As the new year approaches, it's essential to start thinking about your 2024 income planning and how it may impact your retirement savings, particularly when it comes to the 2026 Income-Related Monthly Adjustment Amount (IRMAA) brackets. For those familiar with the Bogleheads.org community, a renowned online forum for investment and personal finance discussions, understanding these brackets is crucial for optimizing your financial strategy. In this article, we'll delve into the importance of income planning for the upcoming year and how the 2026 IRMAA brackets can affect your Medicare Part B and Part D premiums.

Understanding IRMAA Brackets

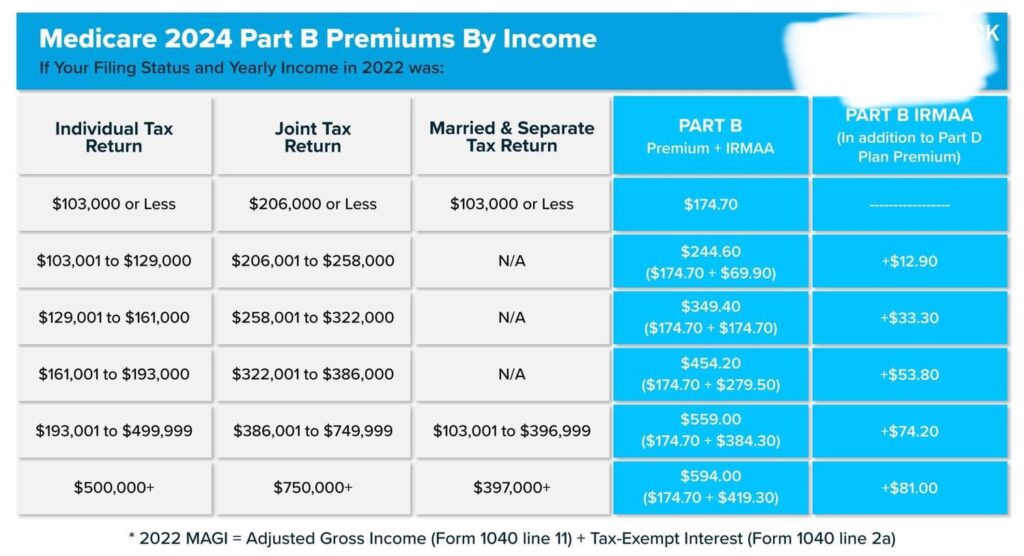

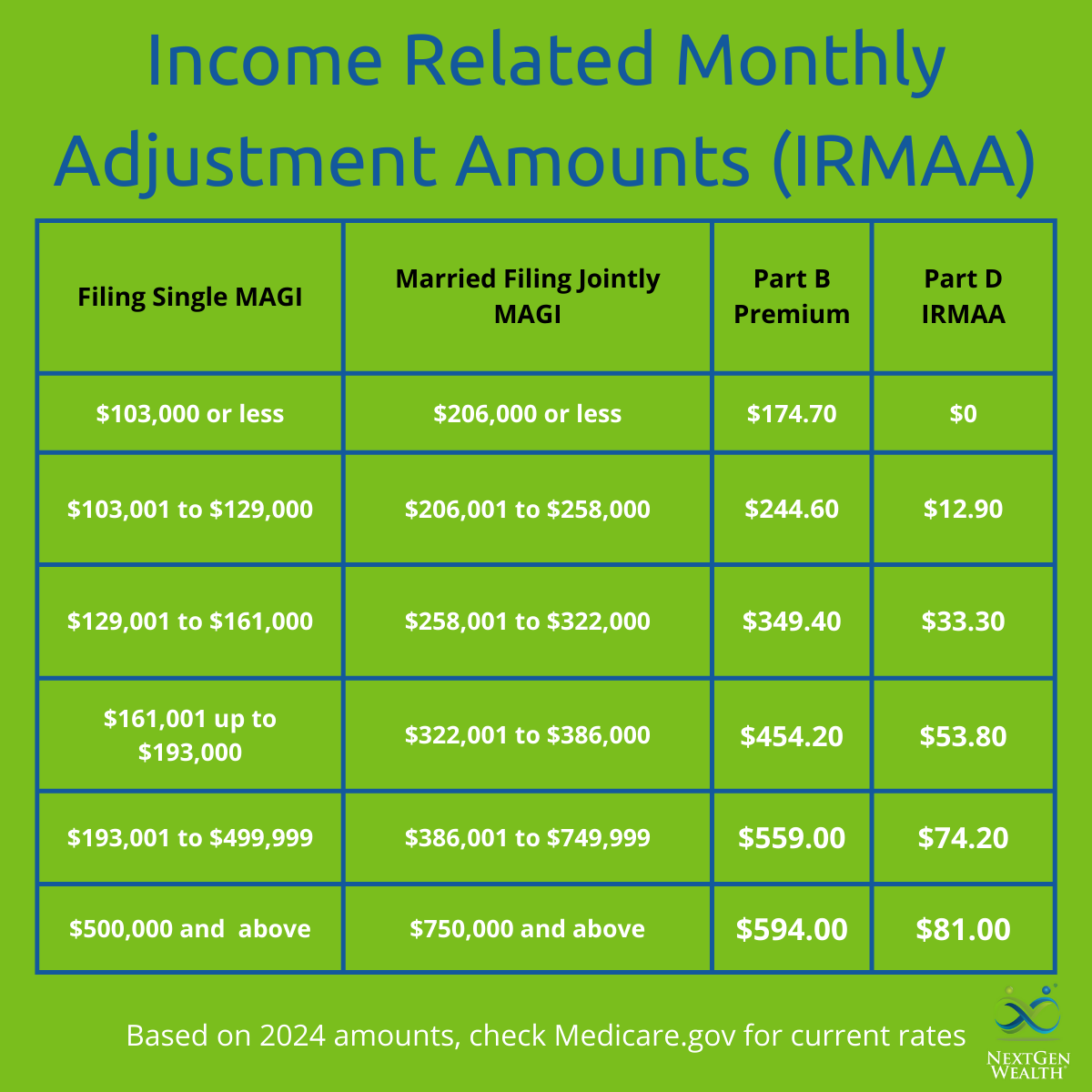

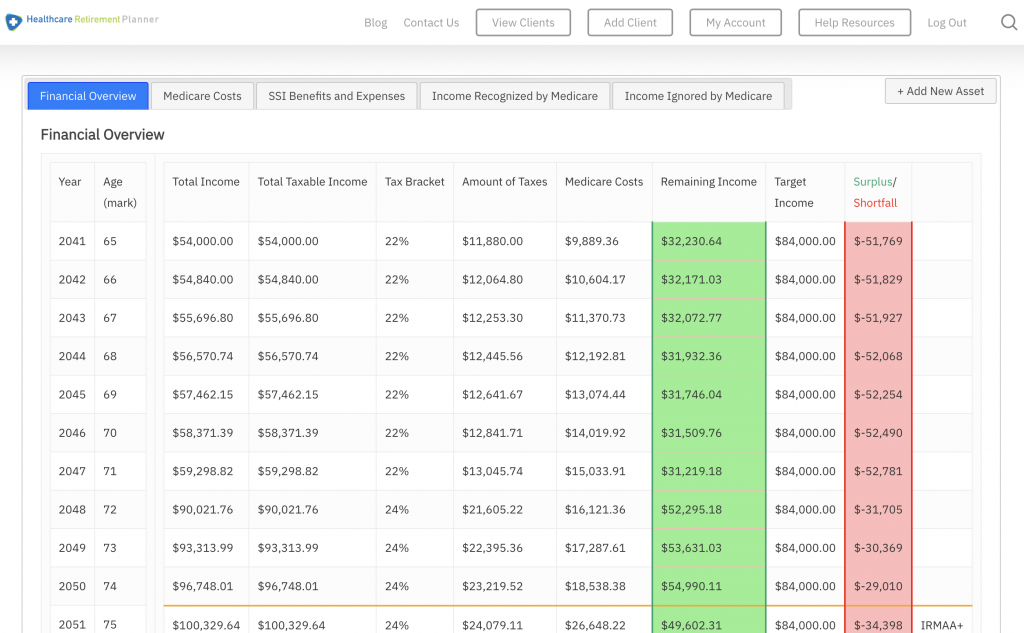

IRMAA, or Income-Related Monthly Adjustment Amount, refers to the surcharge applied to Medicare Part B and Part D premiums for individuals with higher incomes. The IRMAA brackets are adjusted annually and are based on your modified adjusted gross income (MAGI) from two years prior. For instance, the 2026 IRMAA brackets will be determined by your 2024 income. It's vital to plan your income strategically to minimize the impact of IRMAA on your retirement expenses.

2024 Income Planning Strategies

To navigate the 2026 IRMAA brackets effectively, you should consider the following income planning strategies for 2024:

-

Maximize Tax-Deferred Savings: Contributing to tax-deferred accounts such as 401(k), IRA, or Roth IRA can help reduce your MAGI, potentially lowering your IRMAA surcharge.

-

Manage Capital Gains: If you have investments with significant capital gains, consider strategies like tax-loss harvesting or managing the timing of when you realize gains to keep your income below IRMAA thresholds.

-

Consider Roth Conversions: Converting traditional IRA funds to a Roth IRA can increase your income in the year of conversion but may reduce your income in future years, potentially lowering IRMAA surcharges.

2026 IRMAA Brackets: What to Expect

While the exact figures for the 2026 IRMAA brackets have not been announced, understanding how these brackets are structured can help you prepare. Generally, the brackets are adjusted for inflation each year. For the 2025 IRMAA brackets, for example, the base premium for Medicare Part B applies to individuals with incomes below $97,000 and joint filers below $194,000. Above these thresholds, premiums increase according to the IRMAA bracket you fall into.

Planning your income for 2024 with an eye towards the 2026 IRMAA brackets is a proactive step in managing your retirement expenses. By understanding how IRMAA works and implementing strategies to minimize its impact, you can optimize your financial situation. Whether you're a seasoned investor or just starting to plan your retirement, staying informed about changes to IRMAA brackets and adjusting your income planning accordingly can make a significant difference in your long-term financial health. Visit

Bogleheads.org for more in-depth discussions and expert advice on navigating the complexities of retirement planning and IRMAA.

For the most accurate and up-to-date information on the 2026 IRMAA brackets and how they might affect your situation, consult with a financial advisor or visit the official Medicare website. Proactive planning and a deep understanding of the factors influencing your retirement expenses are key to securing a financially stable future.