Table of Contents

- Max Taxable Social Security Wages 2024 - Goldie Colleen

- A Look at Social Security Changes in 2024 - Diener Money Management

- Social Security RAISES & TAXES! Here’s What Congress Just Said - SSI ...

- Will You Have to Pay Tax on Your 2024 Social Security Benefits?

- How Much Is Social Security Withholding 2024 - Codee Devonna

- 8,600 - New Social Security Maximum Taxable Earnings in 2024 - YouTube

- Social Security RAISES & TAXES! Here’s What Congress Just Said - SSI ...

- Social Security RAISES & TAXES! Here’s What Congress Just Said - SSI ...

- 8,600 - New Social Security Maximum Taxable Earnings in 2024 - YouTube

- Social Security Max 2024 Withholding Paycheck - Annora Rozanne

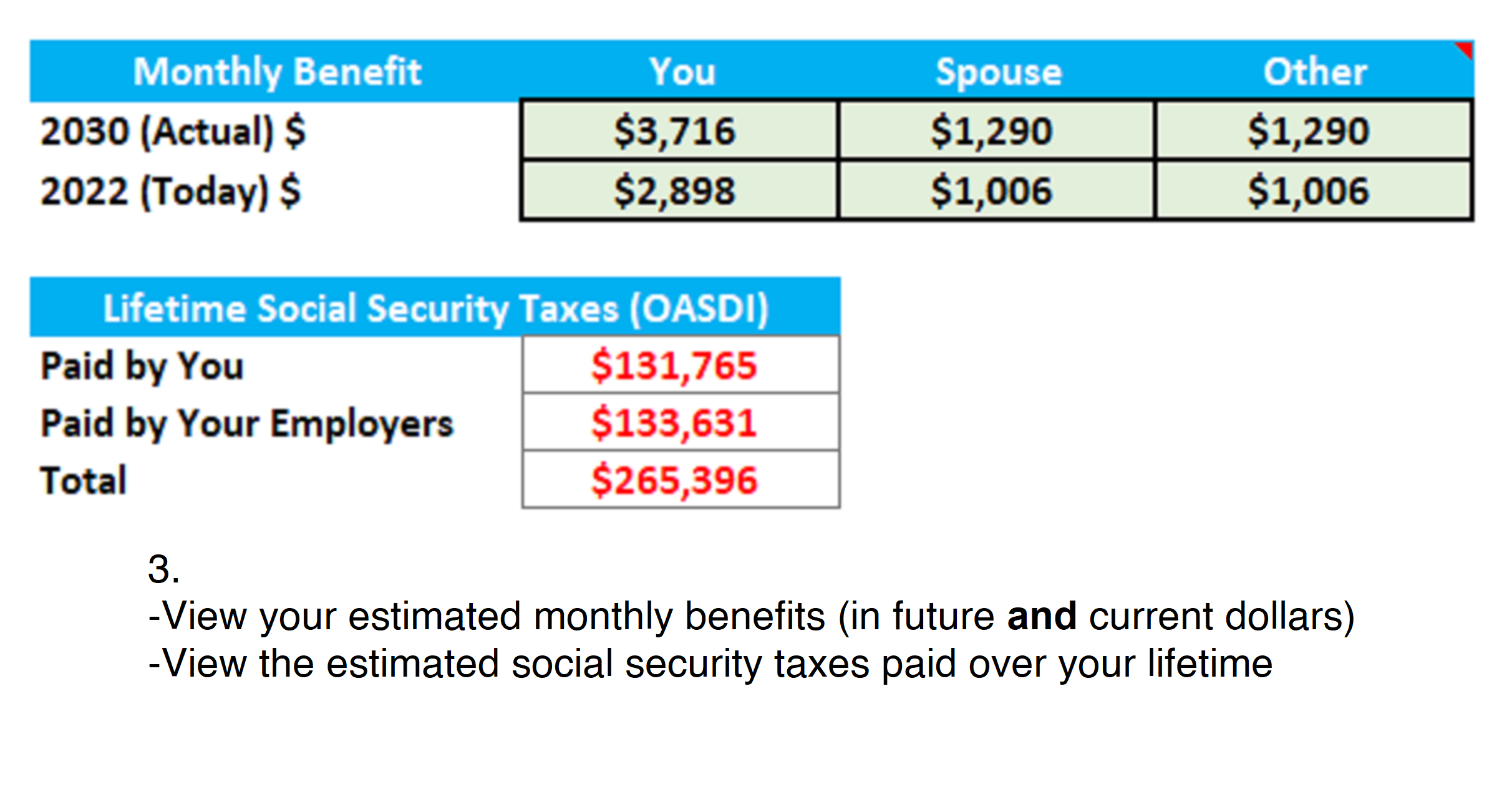

In this article, we'll explore the benefits of using a Benefits Planner, how Social Security tax limits work, and what you need to know to maximize your benefits. Whether you're a retiree, a worker, or a combination of both, understanding how your earnings affect your Social Security benefits is crucial for making informed decisions about your financial future.

What is a Benefits Planner?

- Estimate your retirement benefits

- Understand how your earnings will affect your benefits

- Learn about the Social Security tax limits on your earnings

- Make informed decisions about when to retire and how much to work

Social Security Tax Limits on Your Earnings

For example, if you earn $200,000 in a year, only the first $147,000 will be subject to Social Security taxes. However, your benefits will still be calculated based on your entire earnings history, including the amount above the tax limit.

How Do Social Security Tax Limits Affect Your Benefits?

The Social Security tax limits on your earnings can affect your benefits in several ways:- Reduced benefits: If you continue to work and earn above the tax limit, your benefits may be reduced or delayed.

- Increased benefits: On the other hand, if you have a high earnings history, you may be eligible for higher benefits, even if you're still working.

- Tax implications: Understanding the tax limits on your earnings can help you minimize your tax liability and maximize your benefits.

For more information on Social Security benefits and tax limits, visit the SSA website or consult with a financial advisor. With the right planning and guidance, you can ensure a comfortable and secure retirement.