Table of Contents

- ارزش سهام TSMC با رونق هوش مصنوعی، به بالاترین سطح تاریخ خود رسید

- TSMC: Secular Trends And Market Potential Make It A Strong Buy Ahead Of ...

- TSMC is soon to announce the construction of a factory in Dresden ...

- TSMC Telah Merencanakan Untuk Melakukan Ekspansi Global Dengan Membuka ...

- TSMC can catch up with car-chip demand by end-June: chairman - TechCentral

- TSMC and Samsung Electronics Hit by Major Slump in Chip Sales, TSMC ...

- TSMC Telah Merencanakan Untuk Melakukan Ekspansi Global Dengan Membuka ...

- TSMC shares fall 3.3% after it cuts revenue outlook, delays production ...

- Intel and TSMC Set to Receive "Billions" of Dollars from the US Government

- Warren Buffett: TSMC stock is set to be his biggest winner | The Motley ...

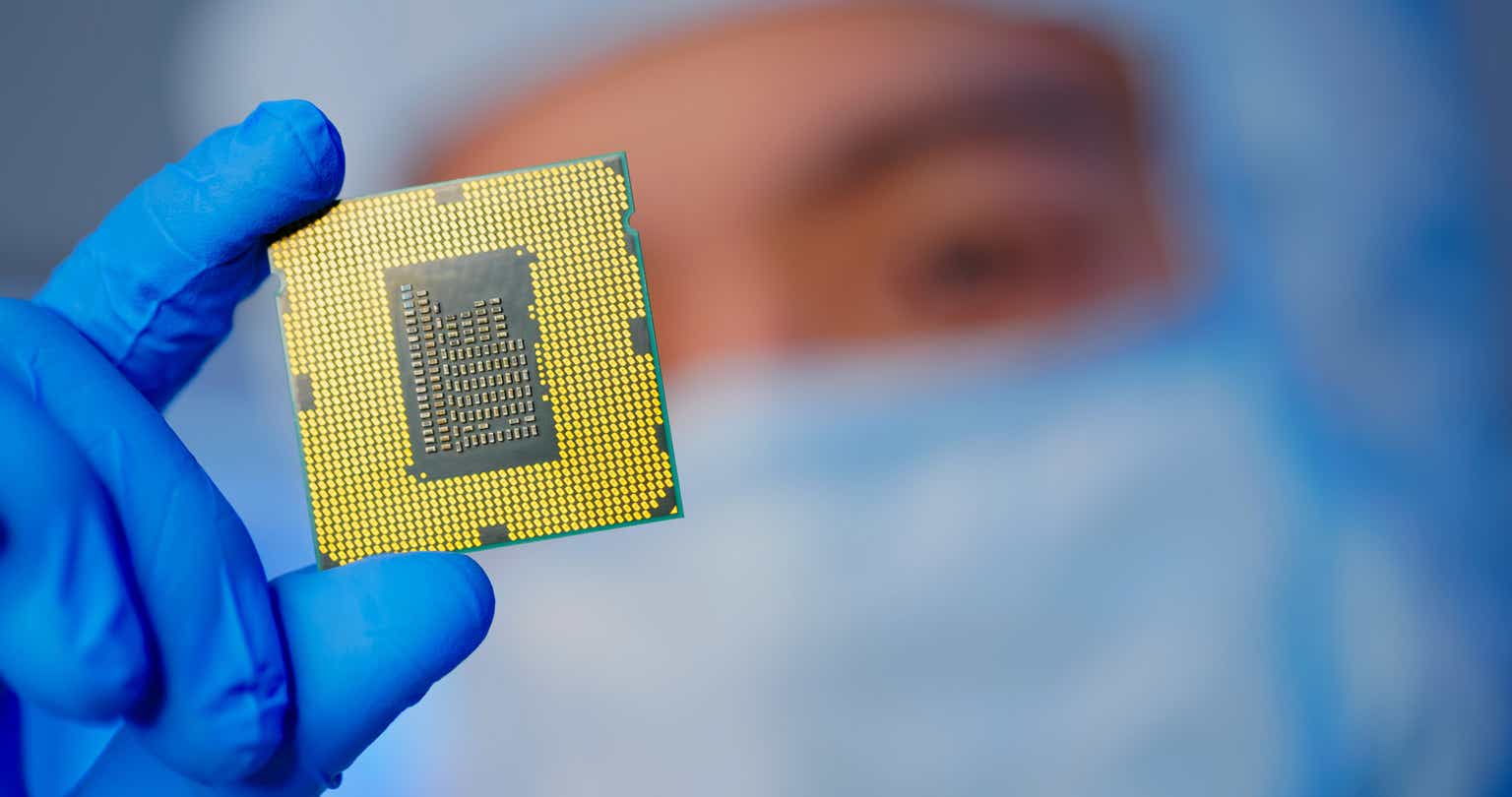

Introduction to TSM

TSM Stock Price: Current Trends

As of the latest market update, the TSM stock price is trading at around $120 per share. The stock has experienced significant growth over the past year, with a 12-month return of over 50%. This surge in stock price can be attributed to the increasing demand for semiconductor chips, driven by the growth of emerging technologies such as 5G, artificial intelligence, and the Internet of Things (IoT).

Historical Performance

To understand the TSM stock price, it's essential to examine its historical performance. Over the past five years, TSM's stock price has consistently outperformed the broader market, with a compound annual growth rate (CAGR) of over 20%. This impressive growth can be attributed to the company's strong financials, including revenue growth, profit margins, and return on equity.

Key Financial Metrics

Revenue: $34.6 billion (2022) Net Income: $13.3 billion (2022) Gross Margin: 53.6% (2022) Return on Equity (ROE): 29.1% (2022)

Future Prospects

Looking ahead, TSM's future prospects appear promising. The company is well-positioned to benefit from the growing demand for advanced semiconductor chips, driven by emerging technologies. Additionally, TSM's strong research and development capabilities, combined with its strategic partnerships with leading technology companies, are expected to drive innovation and growth.

Growth Drivers

Increasing demand for 5G and IoT devices Growing adoption of artificial intelligence and machine learning Expansion into new markets, including automotive and industrial applications In conclusion, the TSM stock price is a key indicator of the company's financial health and growth prospects. With its strong historical performance, promising future prospects, and growing demand for semiconductor chips, TSM is an attractive investment opportunity for investors. However, as with any investment, it's essential to conduct thorough research and consider multiple factors before making a decision. As the technology industry continues to evolve, TSM is well-positioned to play a leading role in shaping the future of semiconductor manufacturing.This article is for informational purposes only and should not be considered as investment advice. Investors should always consult with a financial advisor before making any investment decisions.

Note: The stock price and financial metrics mentioned in this article are subject to change and may not reflect the current market situation.