The cryptocurrency market has been marred by numerous controversies and scandals, with the recent Mantra crash being one of the most significant. The question on everyone's mind is: was it a pump-and-dump scheme orchestrated by centralized exchanges (CEXs)? In this article, we will delve into the details of the Mantra crash, exploring the events that led up to it and examining the evidence that suggests the involvement of CEXs in a potential pump-and-dump scheme.

What is Mantra and How Did it Crash?

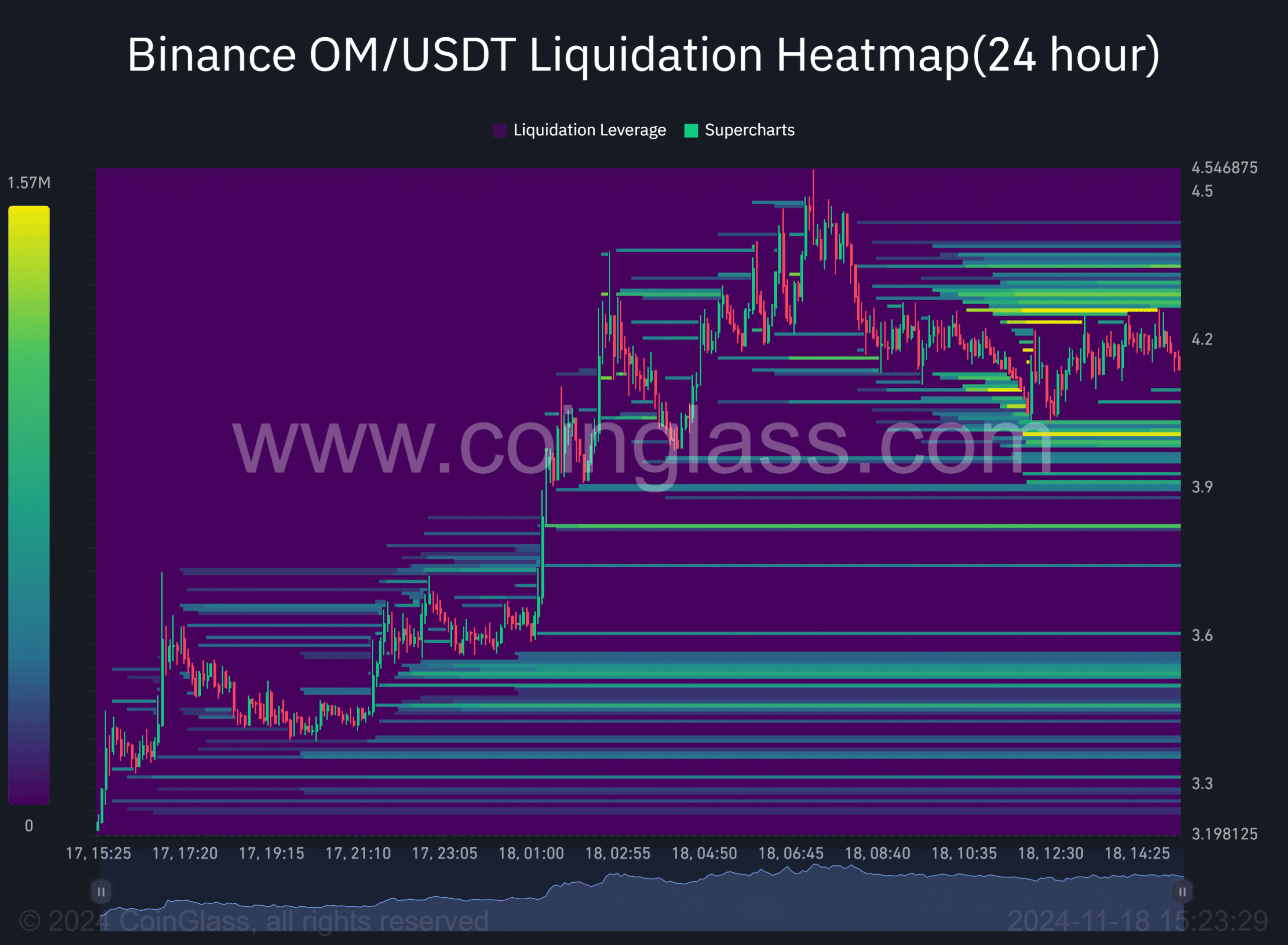

Mantra is a cryptocurrency that was listed on several centralized exchanges, including some of the largest and most reputable ones. The token gained significant traction in the market, with its price surging to unprecedented heights. However, the bubble burst when the token's price plummeted, leaving investors with substantial losses. The crash was sudden and unexpected, with many investors caught off guard.

The Allegations: A Pump-and-Dump Scheme by CEXs

The Mantra crash has sparked allegations of a pump-and-dump scheme, with many pointing fingers at centralized exchanges. A pump-and-dump scheme is a type of market manipulation where a group of individuals artificially inflate the price of a security or asset by spreading false or misleading information. Once the price has been pumped up, the perpetrators sell their holdings, causing the price to crash and leaving innocent investors with significant losses.

In the case of Mantra, it is alleged that CEXs were involved in a pump-and-dump scheme, using their influence and control over the market to artificially inflate the token's price. The exchanges allegedly created a buzz around the token, listing it on their platforms and promoting it through various channels. This created a false sense of demand, which in turn drove up the price.

Evidence of CEX Involvement

While there is no concrete evidence to prove the involvement of CEXs in a pump-and-dump scheme, there are several red flags that suggest their potential complicity. For instance, many CEXs listed Mantra on their platforms despite the token's lack of fundamental value and dubious background. This raises questions about the due diligence and vetting process employed by these exchanges.

Furthermore, the sudden and coordinated listing of Mantra on multiple CEXs has raised eyebrows. This type of coordinated effort is often seen in pump-and-dump schemes, where multiple parties work together to create a false sense of demand and drive up the price.

The Mantra crash has left a trail of destruction in its wake, with many investors losing significant amounts of money. While the exact circumstances surrounding the crash are still unclear, the allegations of a pump-and-dump scheme by CEXs are troubling. As the cryptocurrency market continues to evolve, it is essential that regulatory bodies and exchanges take steps to prevent such manipulative practices.

In the meantime, investors must remain vigilant and cautious, doing their own research and due diligence before investing in any asset. The Mantra crash serves as a stark reminder of the risks involved in the cryptocurrency market and the importance of transparency and accountability.

By understanding the events that led up to the Mantra crash and examining the evidence, we can work towards creating a safer and more transparent market for all investors. As the cryptocurrency market continues to grow and mature, it is essential that we prioritize fairness, integrity, and accountability to prevent such scandals from occurring in the future.

Note: This article is for informational purposes only and should not be considered as investment advice. Always do your own research and consult with a financial advisor before making any investment decisions.