Table of Contents

- Irmaa Brackets 2025 - Karen Arnold

- Irmaa Brackets 2025 And 2026 - Mufi Tabina

- Irmaa Brackets 2025 2025 2026 - Adore Carolee

- 2024 Irmaa Brackets For Medicare Premiums Ssa - Ediva Gwyneth

- Irmaa 2024 Brackets And Premiums Chart - Manda Rozanne

- 2024 Irmaa Brackets For Medicare Premiums Ssa - Ediva Gwyneth

- What IRMAA bracket estimate are you using for 2024? - Bogleheads.org

- Irmaa 2026 Brackets And Premiums Chart - Neila Mirabelle

- What Are The Irmaa Brackets For 2024 - Lucy Leticia

- 2024 Irmaa Brackets Chart Pdf - Amabel Malinde

What is IRMAA?

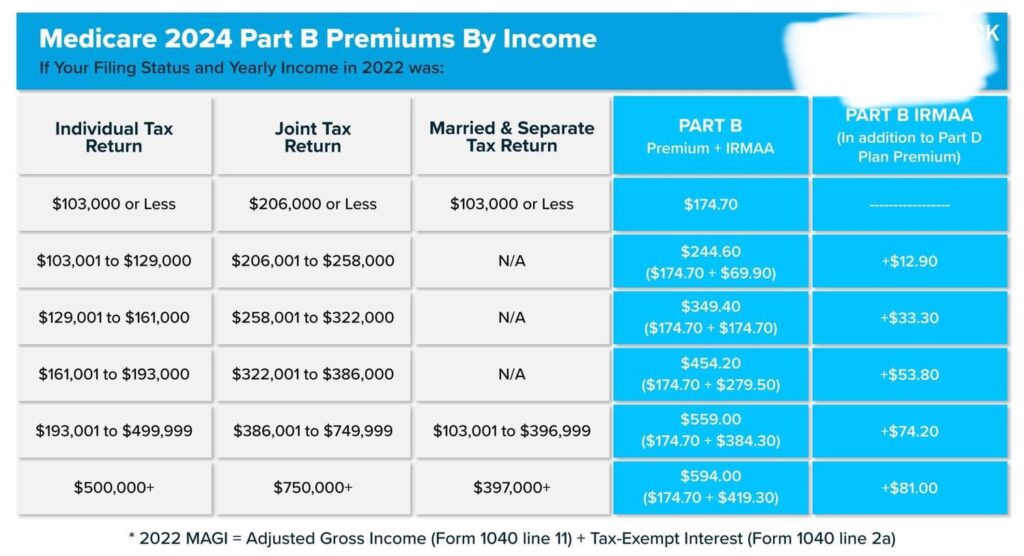

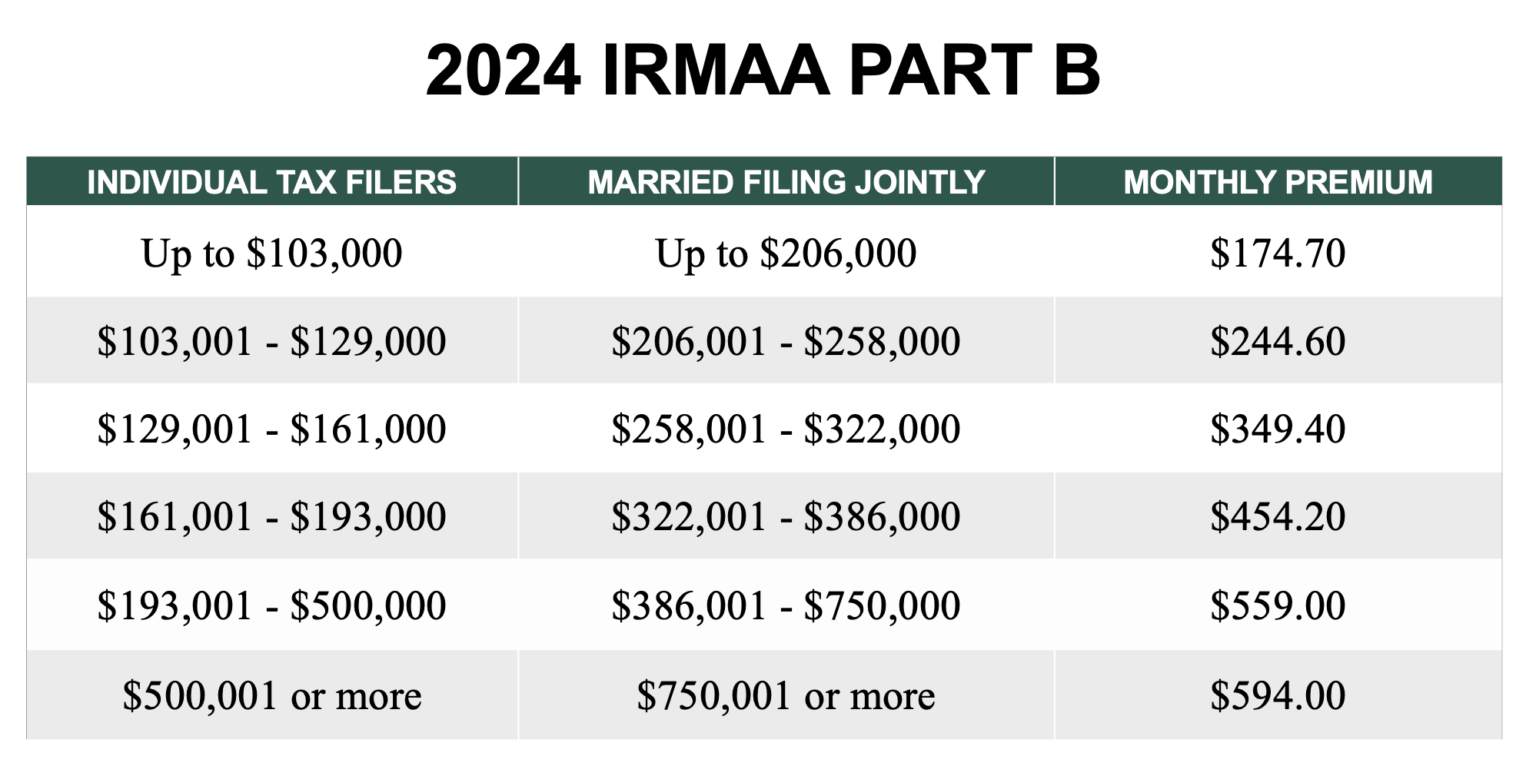

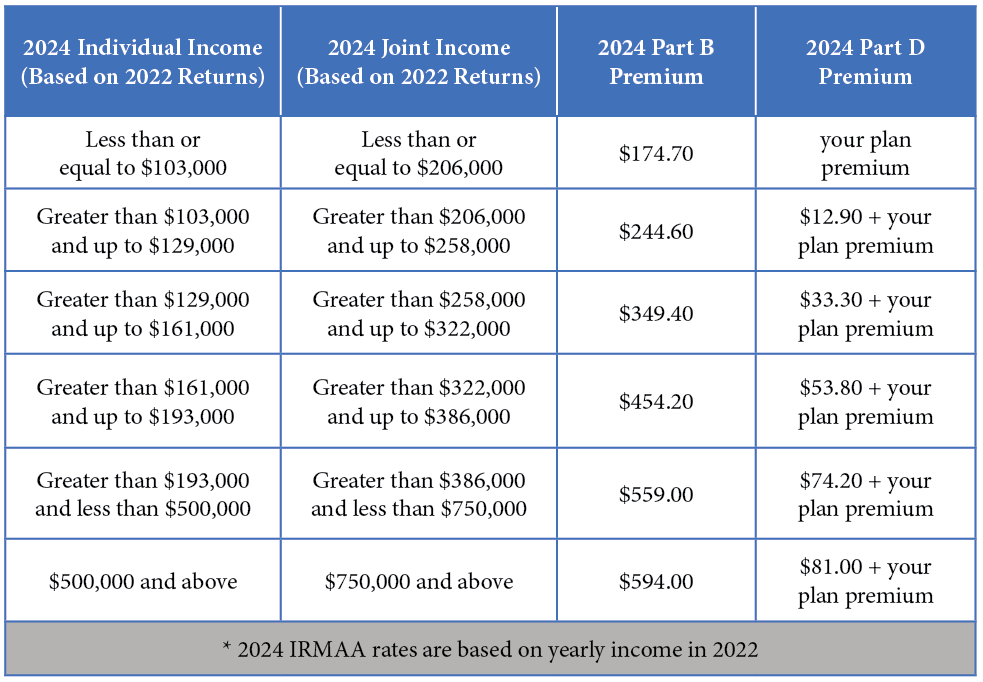

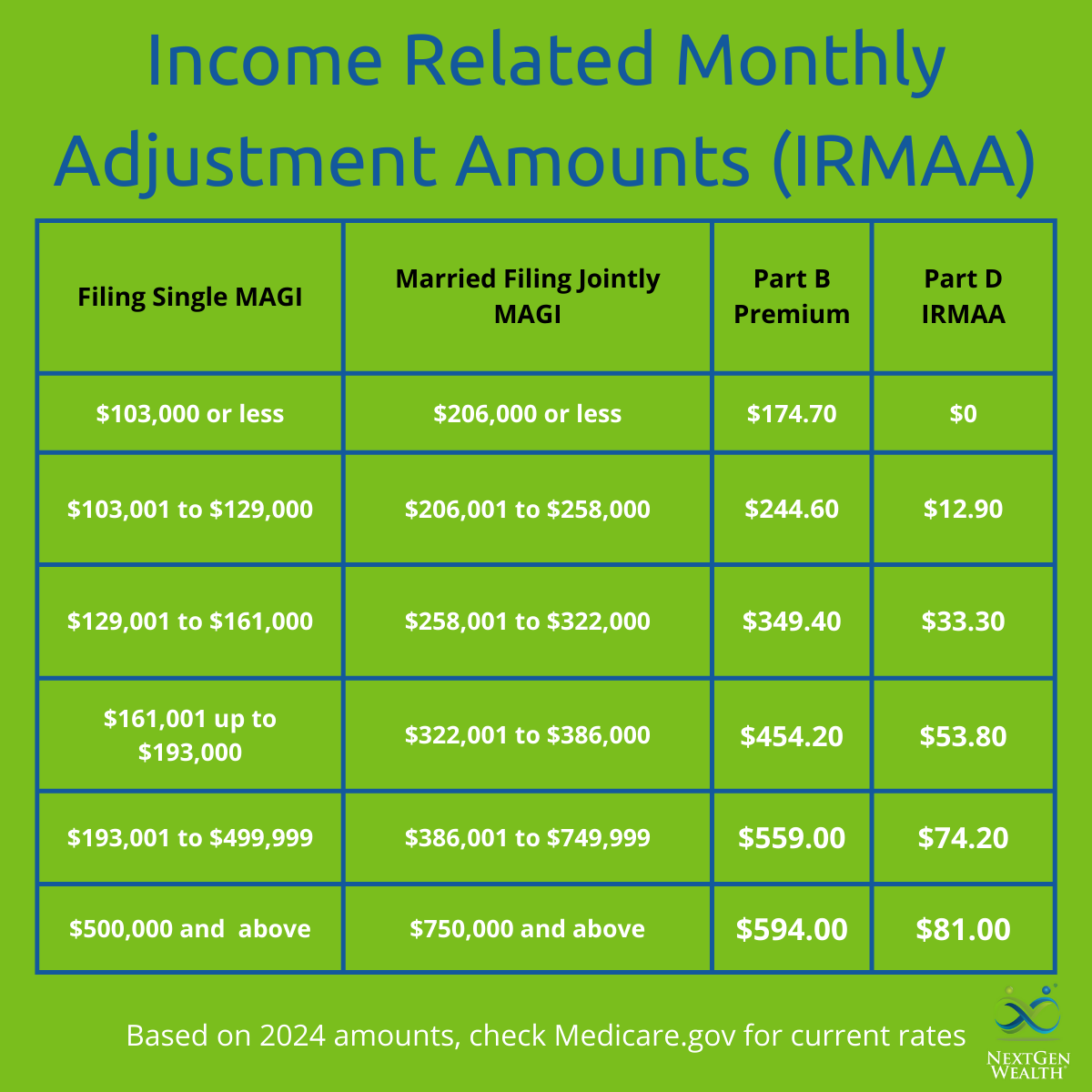

IRMAA Thresholds and Surcharges

IRMAA Solutions

If you're subject to an IRMAA surcharge, there are several solutions you can explore to reduce your premiums: 1. Medicare Advantage Plans: These plans often have lower premiums than traditional Medicare Part B and may not be subject to IRMAA surcharges. 2. Medicare Supplement Insurance: Also known as Medigap, these plans can help cover out-of-pocket expenses, including IRMAA surcharges. 3. Tax Planning: Consulting with a tax professional can help you optimize your income and reduce your MAGI, potentially lowering your IRMAA surcharge. 4. Income Reduction Strategies: Implementing strategies such as Roth IRA conversions or charitable donations can help reduce your MAGI and lower your IRMAA surcharge. IRMAA can be a complex and confusing topic, but understanding the details and exploring available solutions can help you navigate the system and reduce your premiums. By considering Medicare Advantage Plans, Medicare Supplement Insurance, tax planning, and income reduction strategies, you can mitigate the impact of IRMAA on your finances and ensure you're getting the most out of your Medicare benefits. Don't let IRMAA surcharges catch you off guard – take control of your Medicare premiums today.For more information on IRMAA solutions and Medicare planning, contact us or visit our website to learn more about our services.