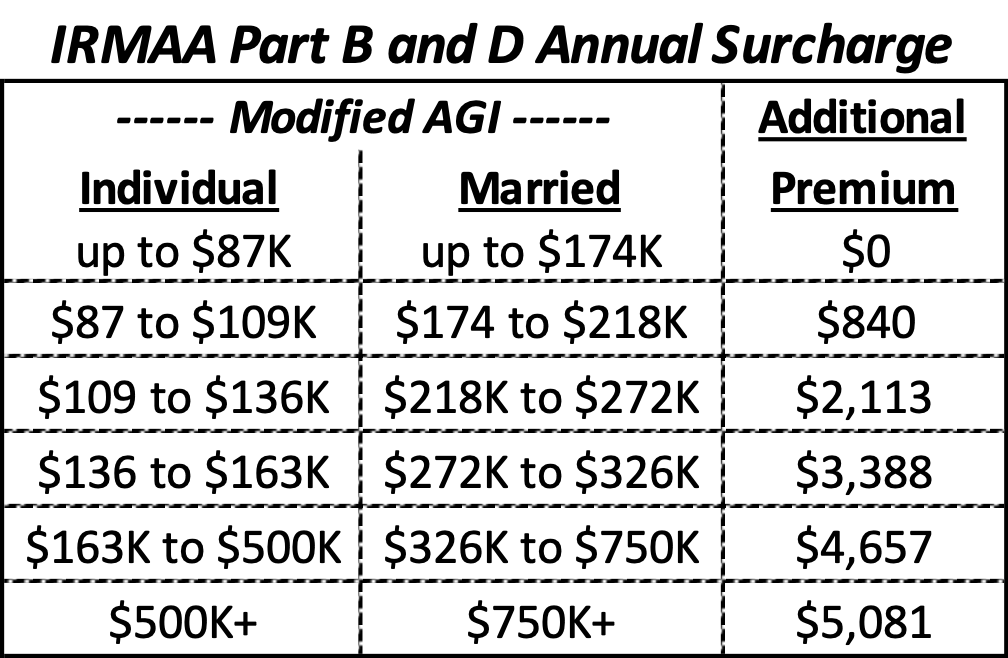

As the Medicare landscape continues to evolve, it's essential for beneficiaries to stay informed about the Income-Related Monthly Adjustment Amount (IRMAA) brackets. IRMAA is a surcharge applied to Medicare Part B and Part D premiums for individuals with higher incomes. In this article, we'll delve into the 2024 and 2025 IRMAA Medicare income brackets, helping you navigate the complexities of Medicare and plan for your healthcare expenses.

What is IRMAA?

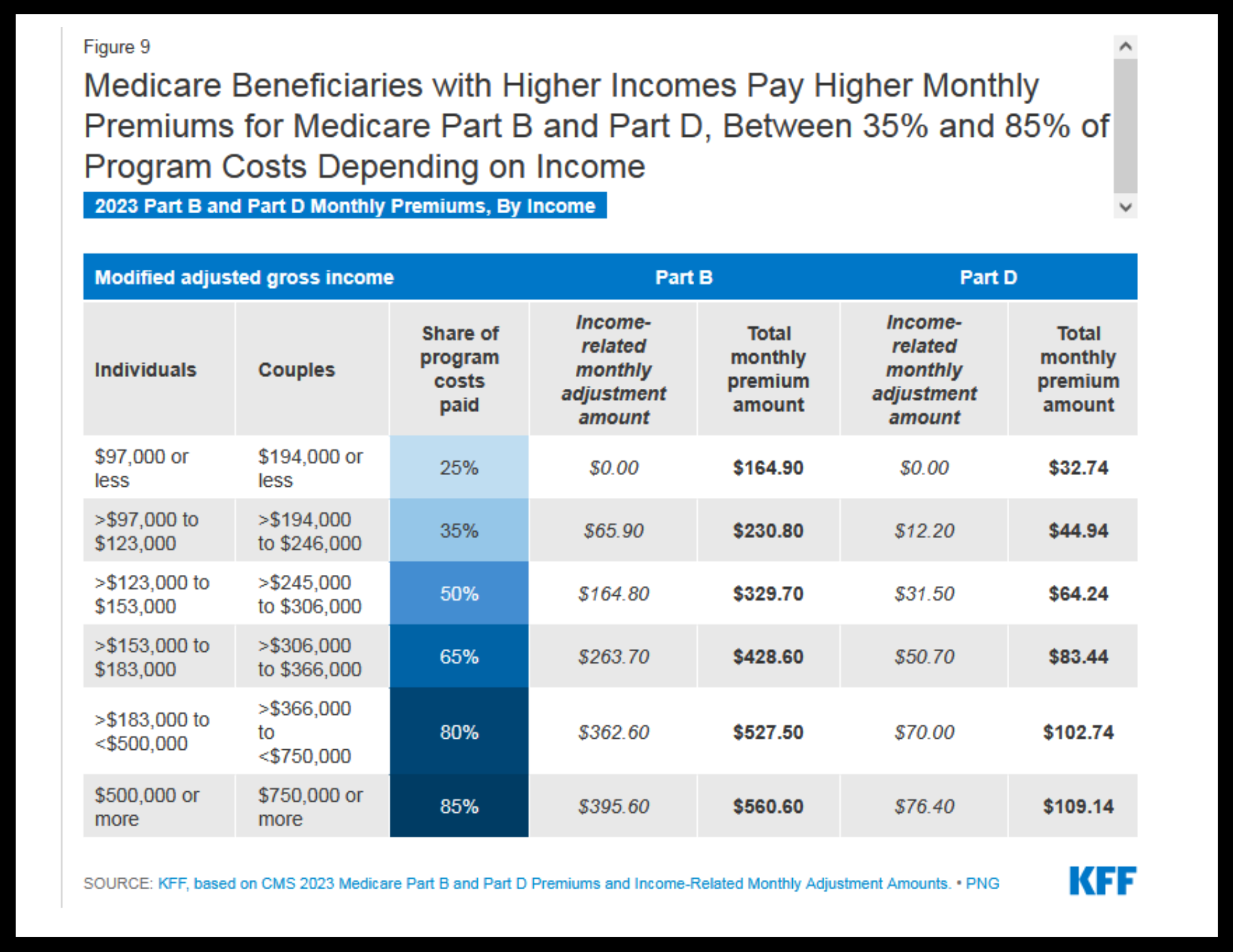

IRMAA is a provision of the Medicare program that adjusts the premium costs of Medicare Part B (medical insurance) and Part D (prescription drug coverage) based on an individual's or couple's modified adjusted gross income (MAGI). The surcharge is designed to ensure that higher-income beneficiaries contribute more to the Medicare program, helping to sustain its financial stability.

2024 IRMAA Medicare Income Brackets

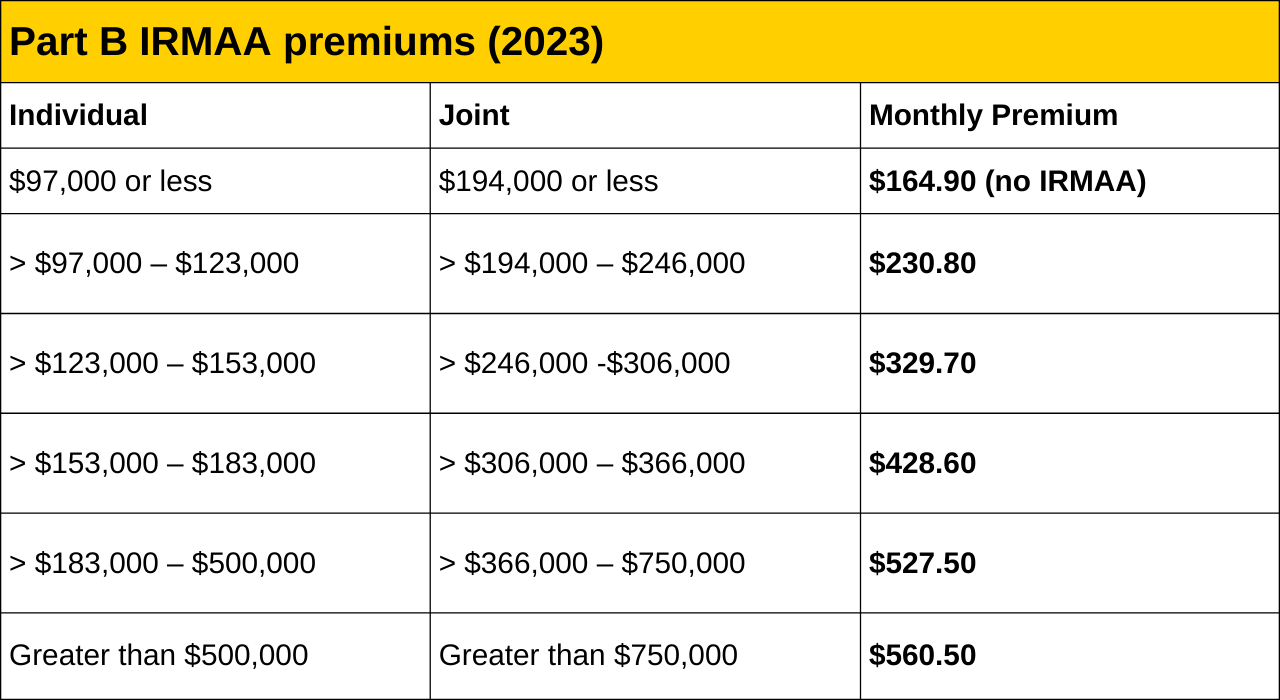

For 2024, the IRMAA brackets are as follows:

Individuals with a MAGI of $97,000 or less and

couples with a MAGI of $194,000 or less: No IRMAA surcharge applies.

Individuals with a MAGI between $97,001 and $123,000 and

couples with a MAGI between $194,001 and $246,000: 2024 IRMAA surcharge applies, resulting in an additional $65.90 to $159.30 per month for Medicare Part B and $12.20 to $76.40 per month for Medicare Part D.

Individuals with a MAGI between $123,001 and $153,000 and

couples with a MAGI between $246,001 and $306,000: 2024 IRMAA surcharge applies, resulting in an additional $159.30 to $238.10 per month for Medicare Part B and $31.50 to $76.40 per month for Medicare Part D.

Individuals with a MAGI between $153,001 and $183,000 and

couples with a MAGI between $306,001 and $366,000: 2024 IRMAA surcharge applies, resulting in an additional $238.10 to $317.10 per month for Medicare Part B and $51.20 to $76.40 per month for Medicare Part D.

Individuals with a MAGI above $183,000 and

couples with a MAGI above $366,000: 2024 IRMAA surcharge applies, resulting in an additional $317.10 to $395.60 per month for Medicare Part B and $76.40 per month for Medicare Part D.

2025 IRMAA Medicare Income Brackets

For 2025, the IRMAA brackets are expected to be adjusted for inflation. Although the official 2025 brackets have not been released, we can anticipate an increase in the income thresholds. Here's a projected outline:

Individuals with a MAGI of $100,000 or less and

couples with a MAGI of $200,000 or less: No IRMAA surcharge applies.

Individuals with a MAGI between $100,001 and $127,000 and

couples with a MAGI between $200,001 and $254,000: 2025 IRMAA surcharge applies, resulting in an additional $67.70 to $164.50 per month for Medicare Part B and $12.70 to $79.10 per month for Medicare Part D.

Individuals with a MAGI between $127,001 and $157,000 and

couples with a MAGI between $254,001 and $314,000: 2025 IRMAA surcharge applies, resulting in an additional $164.50 to $246.30 per month for Medicare Part B and $32.70 to $79.10 per month for Medicare Part D.

Individuals with a MAGI between $157,001 and $187,000 and

couples with a MAGI between $314,001 and $374,000: 2025 IRMAA surcharge applies, resulting in an additional $246.30 to $326.30 per month for Medicare Part B and $52.70 to $79.10 per month for Medicare Part D.

Individuals with a MAGI above $187,000 and

couples with a MAGI above $374,000: 2025 IRMAA surcharge applies, resulting in an additional $326.30 to $409.80 per month for Medicare Part B and $79.10 per month for Medicare Part D.

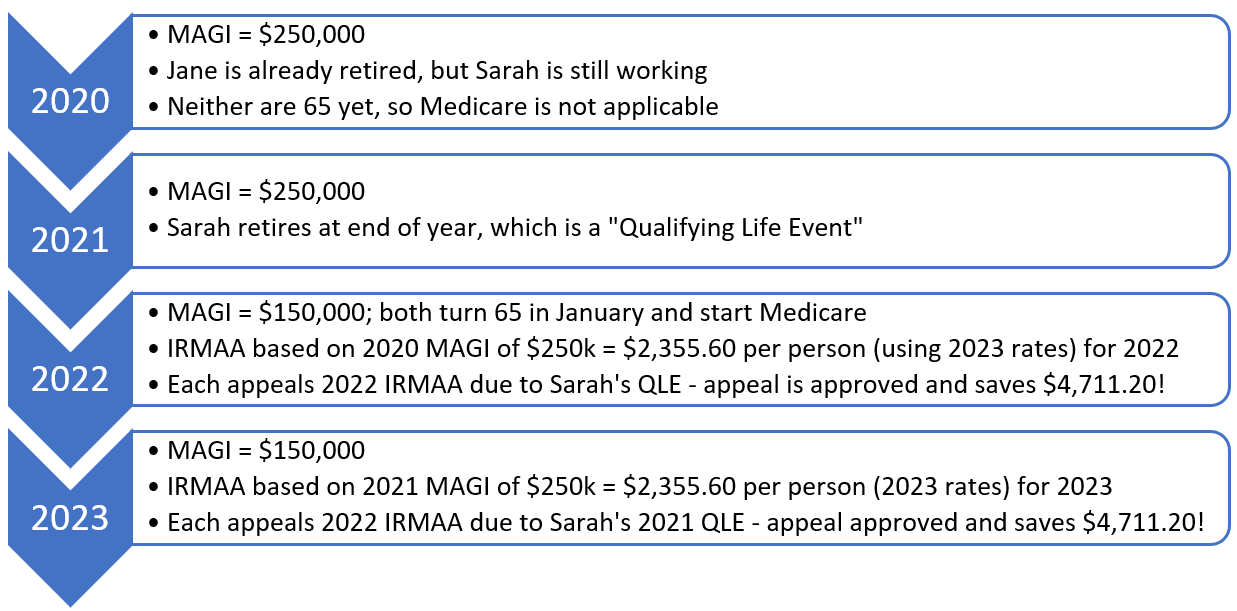

Understanding the IRMAA Medicare income brackets for 2024 and 2025 is crucial for planning your healthcare expenses. By knowing how IRMAA affects your Medicare premiums, you can make informed decisions about your coverage and budget accordingly. Remember to review your income and adjust your Medicare plans as needed to avoid unnecessary surcharges. If you have questions or concerns about IRMAA or Medicare in general, consult with a licensed insurance professional or contact Medicare directly for personalized guidance.