As the global economy continues to evolve, trade agreements and tariffs have become a hot topic of discussion. But what exactly are tariffs, and how do they work? In this article, we'll break down the basics of tariffs, their purpose, and their impact on international trade.

What are Tariffs?

Tariffs are taxes imposed by a government on imported goods and services. They are a common tool used by countries to regulate international trade, protect domestic industries, and generate revenue. Tariffs can be levied on a wide range of products, from raw materials to manufactured goods, and can vary in amount depending on the type of product and the country of origin.

Types of Tariffs

There are several types of tariffs, including:

Ad valorem tariffs: These are tariffs that are calculated as a percentage of the value of the imported good.

Specific tariffs: These are tariffs that are levied as a fixed amount per unit of the imported good.

Compound tariffs: These are tariffs that combine ad valorem and specific tariffs.

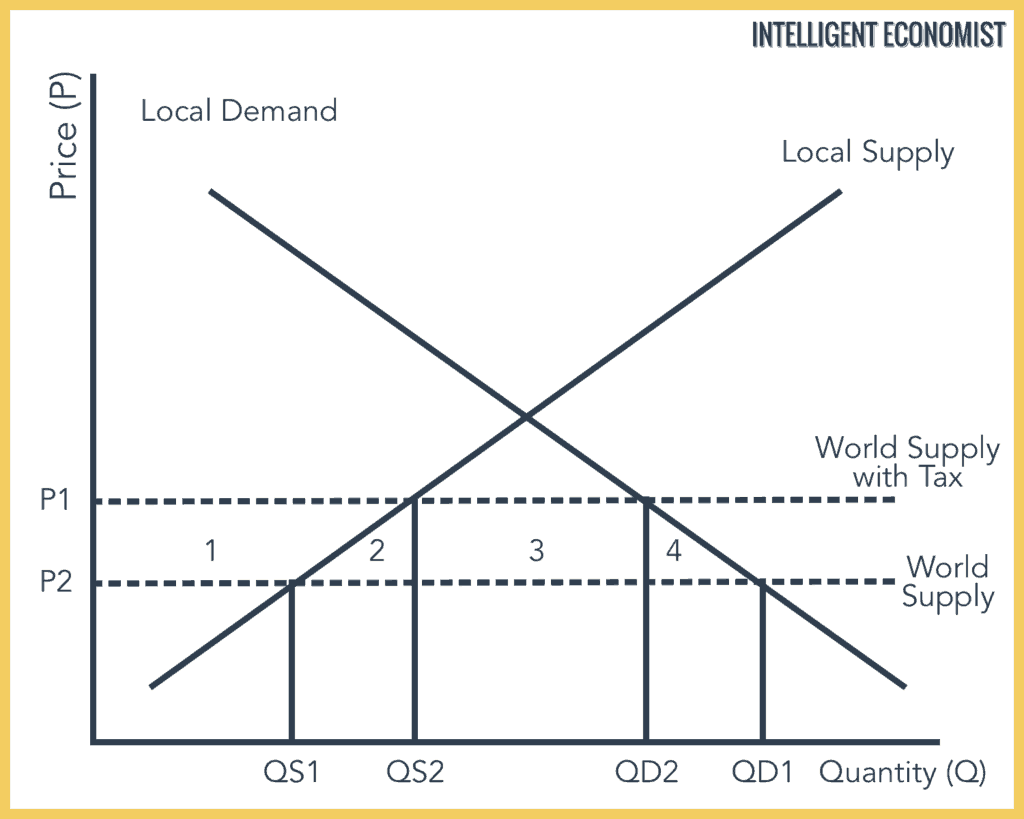

How Do Tariffs Work?

When a country imposes a tariff on an imported good, the importer must pay the tariff amount to the government before the good can be released into the market. The tariff amount is typically calculated based on the value of the good, and is usually paid by the importer.

For example, if a country imposes a 10% ad valorem tariff on imported cars, an importer would have to pay 10% of the value of the car as a tariff. If the car is worth $10,000, the importer would have to pay $1,000 in tariffs.

Purpose of Tariffs

Tariffs serve several purposes, including:

Protecting domestic industries: Tariffs can help protect domestic industries by making imported goods more expensive and less competitive.

Generating revenue: Tariffs can generate significant revenue for governments, which can be used to fund public goods and services.

Regulating trade: Tariffs can be used to regulate trade and prevent unfair trade practices, such as dumping.

Impact of Tariffs

Tariffs can have both positive and negative impacts on the economy. On the one hand, tariffs can help protect domestic industries and generate revenue for governments. On the other hand, tariffs can increase the cost of imported goods, leading to higher prices for consumers and reduced trade.

In recent years, the use of tariffs has become a contentious issue, with some countries imposing tariffs on imported goods in an effort to protect domestic industries. However, this has led to retaliatory measures from other countries, resulting in a trade war.

In conclusion, tariffs are an important tool used by governments to regulate international trade and protect domestic industries. While they can have both positive and negative impacts, it's essential to understand how tariffs work and their purpose. As the global economy continues to evolve, it's crucial to stay informed about trade agreements and tariffs, and how they may affect businesses and consumers alike.

By understanding tariffs and their impact, we can better navigate the complex world of international trade and make informed decisions about the products we buy and the companies we support. Whether you're a business owner, consumer, or simply interested in global trade, this beginner's guide to tariffs provides a comprehensive overview of this important topic.