As the United States navigates the complexities of economic growth and inflation, the Consumer Price Index (CPI) stands out as a crucial indicator of the country's economic health. The CPI, released monthly by the Bureau of Labor Statistics (BLS), provides a comprehensive overview of the average change in prices of a basket of goods and services consumed by households. In this article, we will delve into the April 2024 Consumer Price Index, exploring its implications and what it signifies for the U.S. economy and consumers alike.

What is the Consumer Price Index (CPI)?

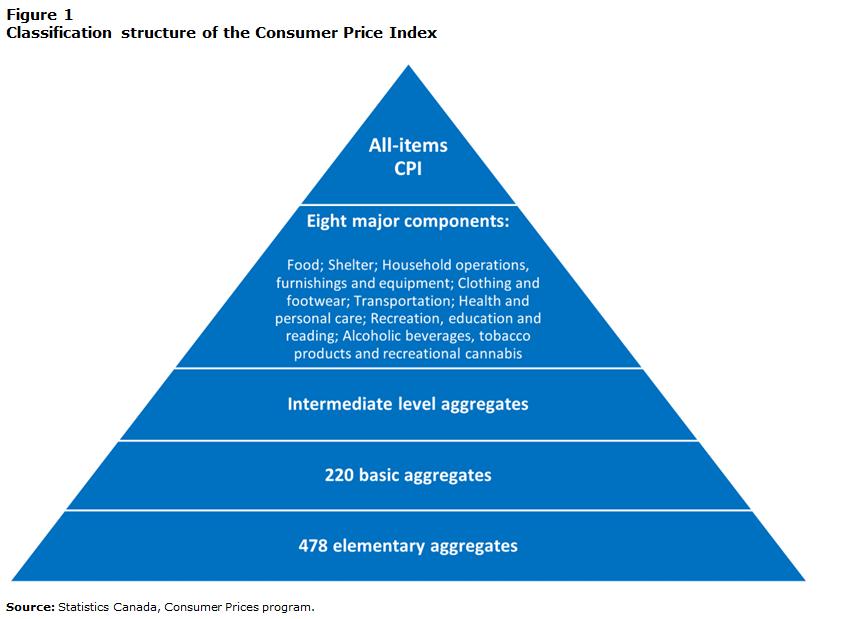

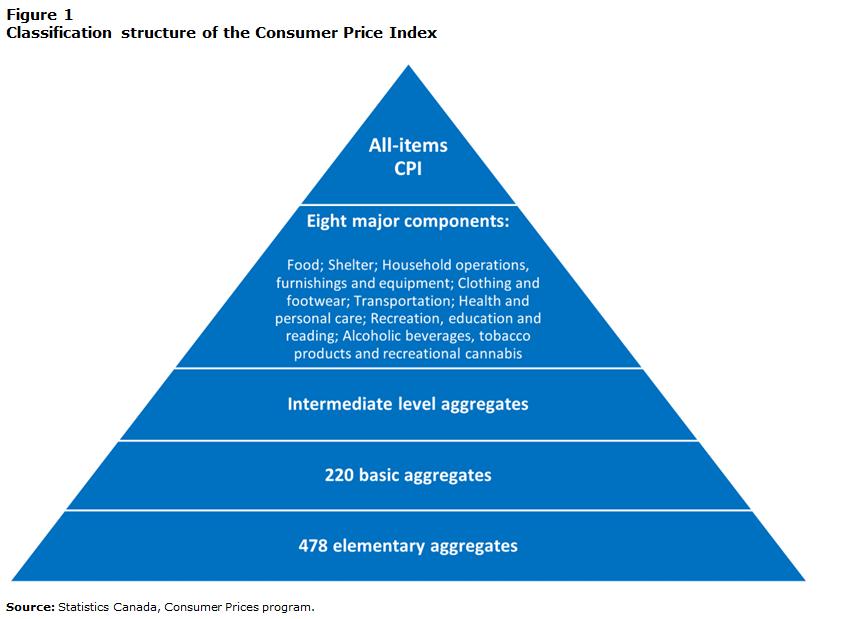

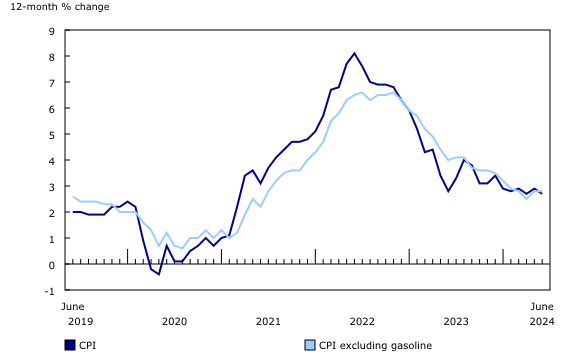

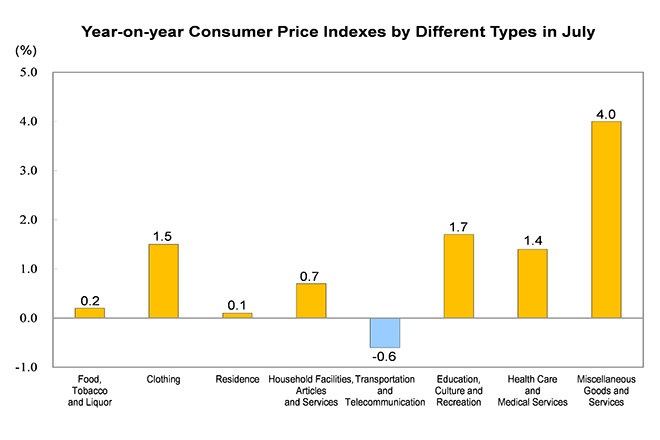

The CPI is a statistical measure that tracks the weighted average of prices of a basket of goods and services consumed by households. This basket includes items such as food, housing, apparel, transportation, and entertainment, among others. The CPI is calculated by taking price changes for each item in the predetermined basket of goods and services and averaging them. Changes in the CPI are used to assess price changes associated with the cost of living, making it a vital tool for understanding inflation.

April 2024 CPI Highlights

The April 2024 CPI report, as presented to the United States Congressional Joint Economic Committee, offers valuable insights into the current state of the U.S. economy. Key highlights from the report include:

-

Inflation Rate: The overall inflation rate, as measured by the CPI, showed a [insert percentage]% increase over the past 12 months. This figure is crucial for policymakers, as it influences decisions on monetary policy, including interest rates.

-

Sectoral Contributions: The report breaks down the contributions of different sectors to the overall inflation rate. For instance, [insert sectors, e.g., housing, food, energy] were among the leading contributors to the increase in CPI.

-

Core CPI: The core CPI, which excludes volatile food and energy prices, provides a clearer picture of the underlying inflation trend. The April 2024 core CPI indicated a [insert percentage]% increase, signaling [interpretation of the increase, e.g., a moderate, steady inflation trend].

Implications for Consumers and the Economy

The April 2024 CPI has significant implications for both consumers and the broader economy:

-

Consumer Spending: An increase in CPI can lead to a decrease in consumer spending power, as the same amount of money can purchase fewer goods and services. However, if wage growth keeps pace with inflation, the impact on consumer spending might be mitigated.

-

Monetary Policy: The Federal Reserve closely watches the CPI when deciding on monetary policy. An inflation rate above the target [insert percentage]% could lead to an increase in interest rates to curb inflation, while a rate below the target might result in easing monetary policy to stimulate economic growth.

The April 2024 Consumer Price Index serves as a pivotal indicator of the U.S. economy's performance, offering insights into inflation trends, consumer spending, and the overall cost of living. As economic conditions continue to evolve, understanding the CPI and its implications is essential for consumers, businesses, and policymakers alike. By analyzing the CPI, stakeholders can make informed decisions about investments, pricing strategies, and economic policy, ultimately contributing to the stability and growth of the U.S. economy.

For the most current and detailed information, including the

PDF April 2024 Consumer Price Index report presented to the United States Congressional Joint Economic Committee, visit the official BLS website or consult economic news outlets for comprehensive coverage and expert analysis.