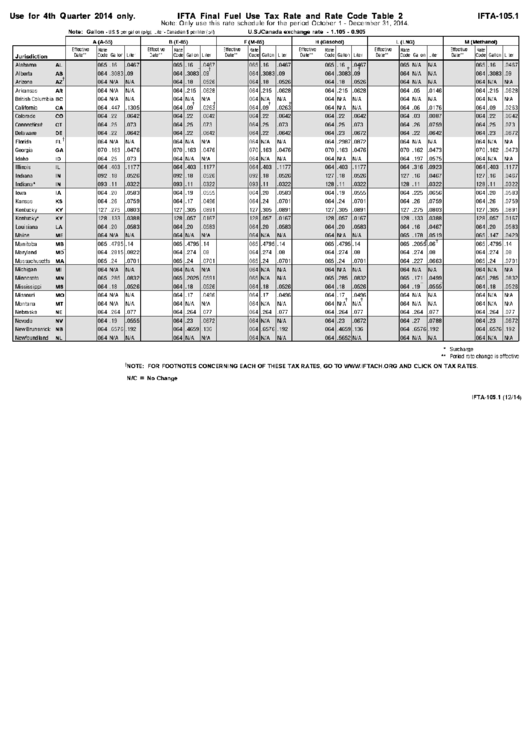

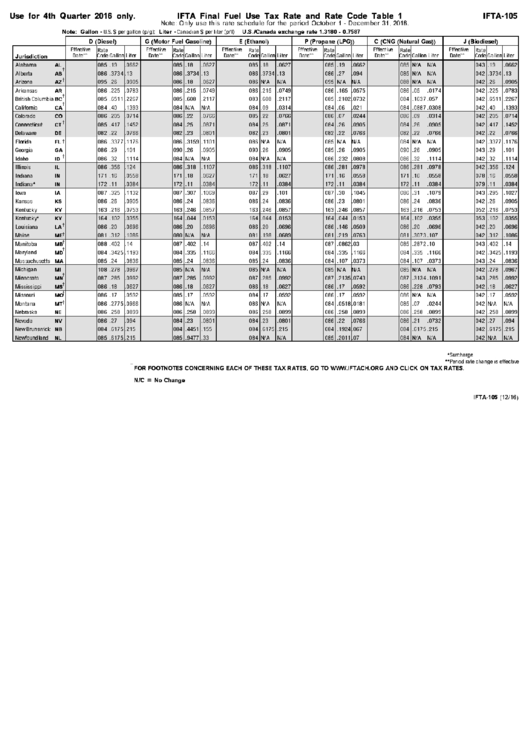

As a trucking company or owner-operator, managing your fuel taxes can be a complex and time-consuming process. The International Fuel Tax Agreement (IFTA) is an agreement between the 48 contiguous United States and 10 Canadian provinces to simplify the reporting of fuel taxes. To help you navigate this process, the

IFTA organization provides a valuable resource: the

PDF IFTA Tax Rate Matrix Calendar 2023-2025. In this article, we'll break down what this calendar is, how to use it, and why it's essential for your business.

What is the IFTA Tax Rate Matrix Calendar?

The IFTA Tax Rate Matrix Calendar is a comprehensive guide that outlines the fuel tax rates for each jurisdiction (state or province) participating in the IFTA program. The calendar covers the years 2023-2025 and provides a detailed matrix of tax rates, including the tax rate per gallon or liter of fuel, as well as any additional fees or surcharges.

Benefits of Using the IFTA Tax Rate Matrix Calendar

Using the IFTA Tax Rate Matrix Calendar can help your business in several ways:

Accurate Tax Reporting: The calendar ensures that you're reporting the correct tax rates for each jurisdiction, reducing the risk of errors or audits.

Simplified Compliance: By having all the tax rates in one place, you can easily manage your fuel tax compliance and avoid costly penalties.

Time Savings: The calendar saves you time and resources by providing a single source of truth for fuel tax rates, eliminating the need to research and verify rates for each jurisdiction.

How to Use the IFTA Tax Rate Matrix Calendar

To get the most out of the IFTA Tax Rate Matrix Calendar, follow these steps:

1.

Download the PDF: Visit the

IFTA website and download the

PDF IFTA Tax Rate Matrix Calendar 2023-2025.

2.

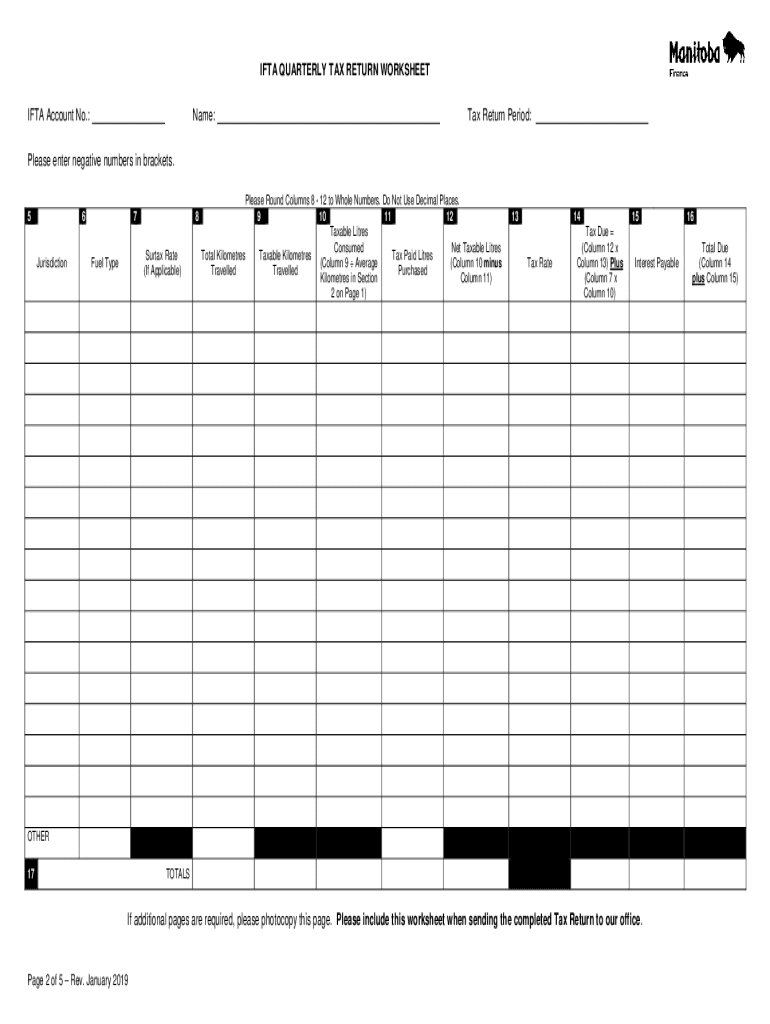

Review the Calendar: Familiarize yourself with the calendar's layout and content, including the tax rates, fees, and surcharges for each jurisdiction.

3.

Update Your Records: Use the calendar to update your fuel tax records and ensure that you're reporting the correct tax rates for each jurisdiction.

4.

Consult with a Tax Professional: If you're unsure about any aspect of the calendar or fuel tax reporting, consult with a qualified tax professional for guidance.

The

PDF IFTA Tax Rate Matrix Calendar 2023-2025 is a valuable resource for trucking companies and owner-operators. By understanding how to use this calendar, you can simplify your fuel tax compliance, reduce errors, and save time and resources. Visit the

IFTA website today to download the calendar and take the first step towards accurate and efficient fuel tax management.

Remember to bookmark this page and visit

iftach.org regularly for the latest updates and resources on IFTA tax rates and compliance.