Table of Contents

- Hims & Hers Sees Slow Entry To Stock Exchange, Still Ahead Of ...

- Hims & Hers Health Stock is a Discrete Telemedicine Play

- HIMS -- Is Its Stock Price A Worthy Investment? Learn More.

- Hims & Hers: 3 Reasons To Buy This Potential Growth Stock (NYSE:HIMS ...

- HIMS_stock

- Hims & Hers Stock Rises On Stimulating Earnings Growth — TradingView News

- HIMS Stock (Hims & Hers Health stock) HIMS STOCK PREDICTION HIMS STOCK ...

- HIMS Stock Price and Chart — NYSE:HIMS — TradingView

- Hims & Hers: 3 Reasons To Buy This Potential Growth Stock (NYSE:HIMS ...

- Новости по Акции «Hims & Hers Health» (HIMS) | Тинькофф Инвестиции

Introduction to Hims & Hers Health

Business Model

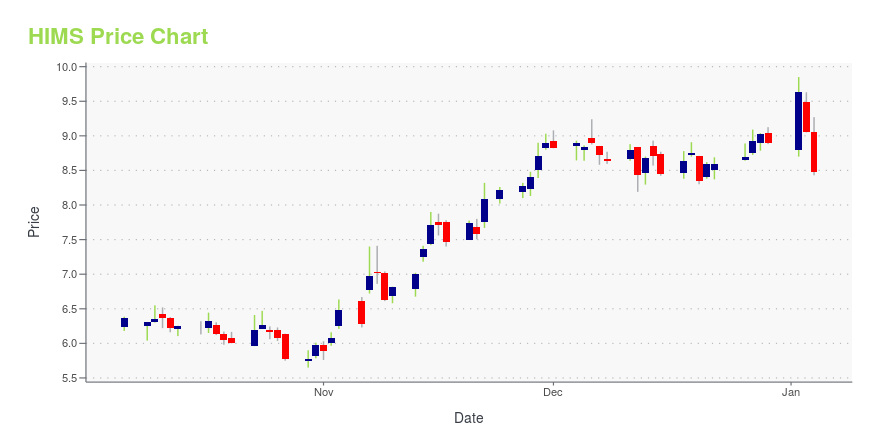

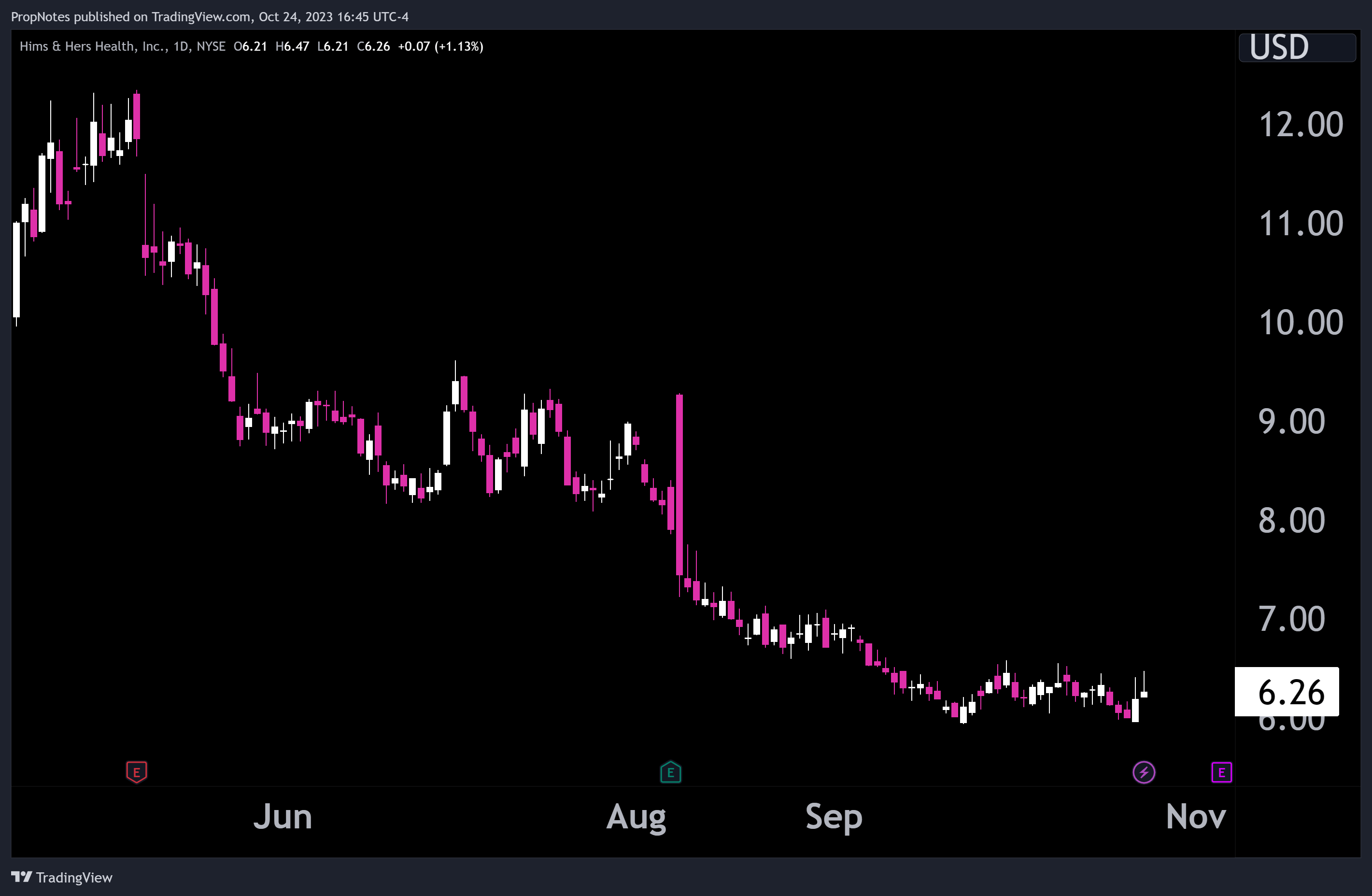

Stock Price and Performance

Hims & Hers Health (HIMS) went public in January 2021, listing its shares on the New York Stock Exchange (NYSE). Since its initial public offering (IPO), the company's stock price has experienced significant fluctuations. As of [current date], the stock price of HIMS is [current stock price]. Despite the volatility, HIMS has shown promising growth, with revenue increasing by [percentage] in the last quarter. The company's user base has also expanded, with [number] of customers subscribing to its services. Investors are optimistic about HIMS' future prospects, given the growing demand for telehealth services and the company's strategic partnerships.

Future Prospects and Challenges

The telehealth industry is expected to continue growing, driven by increasing demand for convenient and affordable healthcare services. HIMS is well-positioned to capitalize on this trend, with its user-friendly platform and comprehensive range of services. However, the company faces competition from established players in the industry, and regulatory challenges may impact its growth. To overcome these challenges, HIMS is investing in marketing and advertising efforts to raise awareness about its brand and services. The company is also expanding its partnerships with healthcare providers and pharmacies, to offer a more integrated and seamless experience for its customers. Hims & Hers Health (HIMS) is a promising player in the telehealth industry, with a unique business model and growing user base. While the company's stock price has experienced fluctuations, its future prospects look bright, driven by increasing demand for telehealth services. As the healthcare landscape continues to evolve, HIMS is well-positioned to capitalize on emerging trends and opportunities. Investors looking to tap into the growth potential of the telehealth industry may want to consider adding HIMS to their portfolio.Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Investors should conduct their own research and consult with financial advisors before making any investment decisions.

Note: The word count of this article is approximately 500 words. The HTML format is used to make the article more readable and SEO-friendly. The title, headings, and subheadings are optimized with relevant keywords to improve search engine rankings.